Last week, on February 11th 2025, we hosted our fifth Embedded Finance Review event in Frankfurt. You might say many activities are repeated when you host your fifth event. Well, some are, and some are not. The fifth event included at least two firsts: our first event in Frankfurt and the first time we focused on the role of banks.

Table of Contents

- What role can banks take in embedded finance?

- Thought Machine’s views on embedded finance

- Panel: How incumbents, neobanks, and SMEs shape B2B Embedded Finance

- Networking and takeaways

But before diving into the details, I want to say a big thank you to Banxware and Thought Machine for sponsoring this event. This event had perhaps the shortest phase from idea to announcement, and it was only possible because of our sponsors.

The setup for our fifth event

In a way, it was apparent that you should focus on the role of banks in embedded finance when you host an embedded finance event in Frankfurt. Frankfurt is the capital of traditional financial services in Germany, and if you want to get bankers into the audience, this is the place to be. Not only that, but hosting the event at Tech Quartier and partnering with the Frankfurt Digital Finance Conference was a logical choice for us.

This resulted in a fully booked event, and the room was packed during the presentations and networking. I didn’t fully realise this during the presentations, but I was pleasantly surprised when a few people approached me during the networking and mentioned they did not expect that many people to attend.

Insights from the stage

What role can banks take in embedded finance?

In my presentation, I introduced the concept of embedded finance and the potential roles I see for incumbent banks. My events target not only embedded finance professionals but also those who are working at non-financial brands and financial institutions that are just starting. Therefore, there is always a fine line between getting everybody on the same page and going into some details.

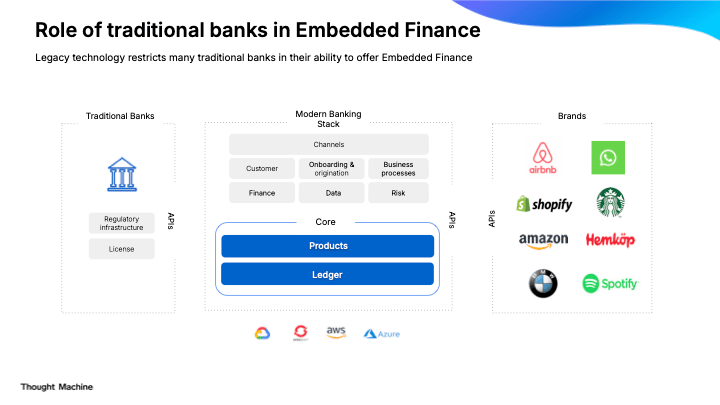

When it came to the potential role of banks in embedded finance, I highlighted that those banks that want to do something in embedded finance have a critical choice to make. They can either be in the front end or the back end. If the bank chooses to be in the front end, it must build and launch non-financial products. Otherwise, we would not consider it as an embedded finance product. We see some banks doing it, especially in the context of accounting and bookkeeping for SMEs, but the possibilities are limited. Therefore, most banks will likely need to go into the backend to play a role in embedded finance. However, the possibilities are even bigger and more complex in the backend.

If you are interested in my slides, you can download them here:

PS: If you are looking for embedded finance slides, check out my 29-slide intro guide.

Thought Machine’s views on embedded finance

Many embedded finance experts might wonder what a core banking provider like Thought Machine does in embedded finance. While its core banking product is not purely designed for embedded finance, the British company has scored some global customers that operate in embedded finance in one way or another. Perhaps most notably for us, Thought Machine is the provider of choice for SEB Embedded, the Scandinavian bank unit that offers banking-as-a-service.

SEB decided not to use the existing bank’s infrastructure for their banking-as-a-service unit but instead partnered with a company that enables them to design and launch new products quickly. This was the central point for Thought Machine’s David Mueller on our stage when presenting their views on embedded finance.

Panel: How incumbents, neobanks, and SMEs shape B2B Embedded Finance

After two presentations, it was time for our panel. Mandya Aziz from Banxware discussed the role of incumbent banks in embedded finance with panellists Miriam Wohlfarth (Banxware), Dora Ziambra (Tide), Dr. Markus Ampenberger (BCG), and Alex Mueller (Holvi) and examined the ecosystem from various perspectives.

What stuck with me from the panel (not actual quotes but paraphrased):

- When incumbent banks enter embedded finance, the business model is an important question, but the operating model is probably even more crucial (Markus)

- The speed in embedded finance and fintech infrastructure keeps increasing; what took more than a year a few years ago can now be done within months (Alex)

- Embedded finance is not the answer to everything and everywhere; it depends on customer value, financial products and markets (Dora)

- Banks should focus not only on their core products but the overall needs of their clients; in some cases, partnering is better than building (Miriam)

- Embedded finance is a threat and an opportunity for banks, depending on the bank’s mindset and actions (Markus)

Networking and takeaways

After the insightful panel, we moved on to the most essential part of the event: networking. I always say this with a wink, but I assume most people get the most out of such events during the networking. Every possible stakeholder from the embedded finance ecosystem was present, and I had many interesting discussions.

Overall, my personal takeaways from the event were:

- Again, I was very glad to see such a significant interest in the topic, especially in a city like Frankfurt, where the crowd is very different to Berlin

- Small evening gatherings are typically not the place for big announcements, but they are focused on learning and building your network.

- Incumbent banks have an essential choice with the rise of embedded finance. They can take various paths, but they should keep in mind that not making a choice is also a choice

I am already planning the next event in April in Berlin and more events for the second half of 2025. Do you want to partner? Get in touch!