Welcome to Embedded Finance Review, where I make embedded finance more accessible via weekly newsletters, biweekly podcasts, and events.

This newsletter went out to {{active_subscriber_count}} subscribers. If you want to support my work, you can upgrade to premium or become a sponsor.

Hi {{first name|embedded finance friend}}

I have written this newsletter at record speed. But somehow I did not come up with a relevant message for this welcome paragraph.

Since I don’t want to waste your or my time, let’s dive right in 👇

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

How can we solve payments in the construction industry? (Podcast)

Jarvey Moss is neither from the construction nor the payment industry. But he has seen firsthand how existing payment flows put certain companies in the construction industry at risk.

He decided to fix this with Saible. I invited him to the podcast to speak about:

- The current tech and fintech stack of construction companies

- How the industry is changing

- How Saible is fixing payments in the construction industry

And if you wonder whether Saible is really an embedded finance company, listen to the episode and hear Jarvey's surprising answer.

You can find the episode on Spotify, Apple Podcasts, and YouTube.

Barclays completes Tesco Bank acquisition

What happened: British Bank Barclays announced that it has completed the acquisition of Tesco Bank (Barclays). Over the past few months, Tesco has announced its intention to part ways with its financial services subsidiary and in February it was announced that Barclays is going to be the buyer. Both companies have now finalised all necessary formalities and the deal is done.

The well-known Tesco Bank brand will continue to exist even though Tesco will no longer own Tesco Bank. Barclays made a deal with Tesco, allowing them to not only keep the brand but also to sell financial products inside Tesco branches for at least the next ten years.

My comment: This announcement concludes Tesco’s journey to own the whole value chain of financial services. Owning and maintaining the bank licence was a big burden for the retailer and likely drove the decision to part ways. Tesco mentioned that even though they are selling Tesco Bank, they are still interested in exploring distributing financial services to their customers. The partnership with Barclays to sell financial securities in Tesco branches underlines this.

Retailers are often described as well positioned to offer financial services. The size of their business, the relevance of loyalty and the repeated purchase behaviour of their customers are the main drivers. That being said, it is not easy for any company to launch financial products but especially retailers often struggle to create a compelling product experience. Just because a retailer has many customers and could offer financial services doesn’t mean they should. The main question, as usual, is what value it creates for their customers. None of us needs ‘just another bank account’.

Brazilian Central Bank launches public consultation to regulate BaaS

What happened: The Brazilian regulator announced a public consultation to regulate banking-as-a-service (Finsiders Brazil). Like in many other countries, the concept has taken off over the past few years in Brazil. Banking-as-a-service is not only relevant for embedded finance but fintech in general. It allows companies without a licence to offer financial services in partnership with licenced providers. Receiving and maintaining a licence is costly and time-consuming; thus, the concept of banking-as-a-service can be beneficial for all parties involved. However, the devil lies in the details and very often these partnerships are not properly set up. The Brazilian regulator highlights examples of un-regulated providers offering banking products in partnership with a regulated provider but not making this clear to their customers or other instances where providers offered payments via the popular PIX network without the required account structures (Finsiders Brazil).

My comment: There is a strong call for deregulation in Europe and this may be in many instances appropriate. But when it comes to embedded finance and banking-as-a-service, I believe regulation can be very helpful. Consumers need to trust providers of financial services and this is much harder for companies to achieve if have never offered them before. And one black sheep can destroy the work from a lot of providers with good intentions.

That being said, regulation can have many shapes and forms. And I do see a big risk, especially for embedded finance, when a new regulation is not fit for purpose. It gets increasingly harder for regulators to understand and follow new concepts in fintech and embedded finance. Thus, I hope this public consultation creates sufficient relevant responses and the regulator has the time and resources to study them appropriately.

What the change in US sponsor bank market means for the industry

A few articles about the US banking-as-a-service market have caught my eyes this week.

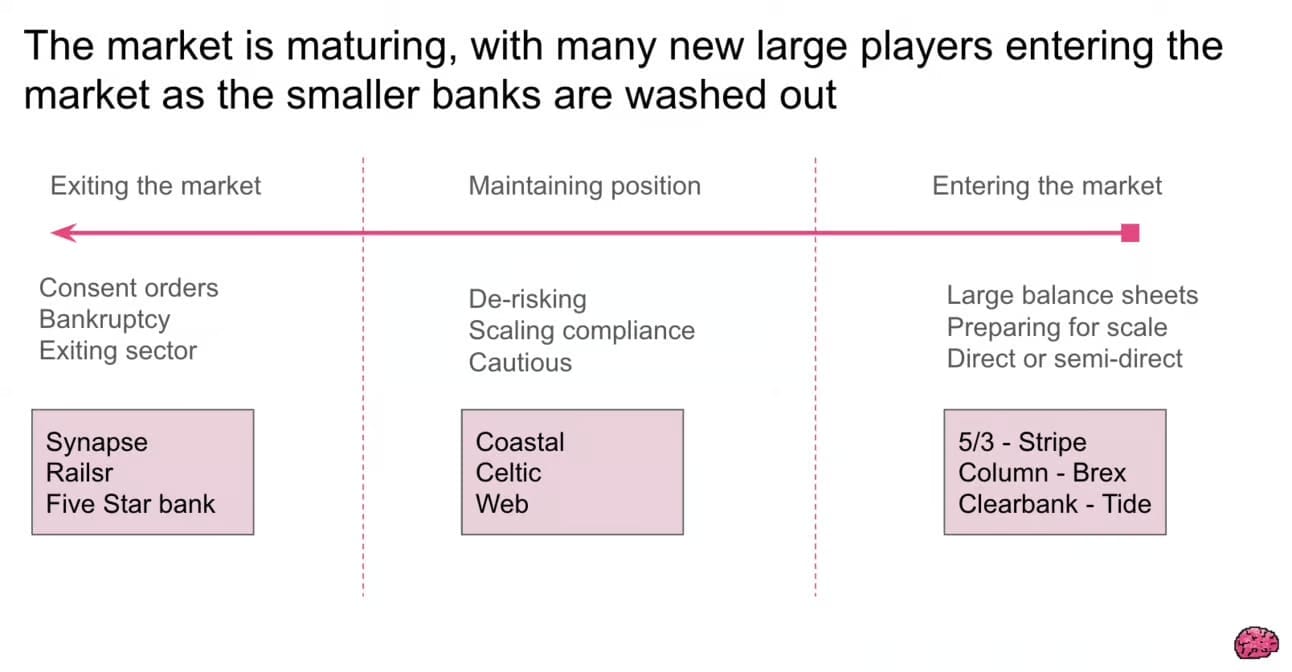

Firstly, Simon Taylor highlighted in his weekly Fintech Brainfood that due to the actions of regulators, many banks have reconsidered their choice to play a role in embedded finance and banking-as-a-service. Luckily, there are many banks that are doubling down, like Fifth Third Bank and Green Dot. However, many banks are also reducing their activities and some even completely shut down their efforts. Simon notices that those who are able to sell to enterprises or big tech companies are more likely to continue but they will also be more selective. This could potentially mean that only large companies are able to launch new financial products.

This is being echoed in a similar way by Tearsheet’s article, that says that US sponsor banks need to focus on quality partnerships and not quantity. The article does not say that only larger companies are quality; however, you could argue that this is likely the case.

Simon ends his piece with the ask to various industry stakeholders to keep working so that potential sponsor banks are “drowning in resources to do their job well”. I guess we all agree that embedded finance can have a very big positive impact on society, but there are a lot of challenges. Education and knowledge are necessary elements to solve them. Therefore, sponsor banks must find the right talent, which is what this American Banker article argues.

Shopify Finance streamlines merchants financial lives

What happened: US embedded finance rolemodel Shopify has introduced Shopify Finance, the new place for all Shopify’s financial products (PYMNTS).

The e-commerce giant offers a banking product (Shopify Balance), a credit card (Shopify Credit), a financing solution (Shopify Capital), an accounts payable product (Shopify Bill Pay) and a tax service (Shopify Tax). With the new change, Shopify’s e-commerce merchants can find all these products in one place in their digital dashboard.

My comment: It may be just a small frontend change, without any new product being introduced. However, I thought immediately this is “Bank Shopify”. Any financial products or features that an e-commerce merchant would previously find in their bank’s online banking is now available in a central place in Shopify. This is un-bundling and re-bundling of financial services at its best.

Link section

- Top 5 jurisdictions to obtain EMI licence in 2025 (Finextra).

- Adyen goes live with Tap to Pay on iPhone in additional European markets (Finextra).

- Affirm introduces pay-over-time options in the UK (The Paypers).

- US payroll provider Gusto launched an embedded product offering last year. In this video interview, co-founder Tomer London explains their move (Youtube).

- Turning payments Into deposits fuels the next era of embedded banking (PYMNTS)