Hi friends

Almost two weeks ago, I hosted the second Embedded Finance Review event in Berlin. I received overall positive feedback, and many asked when the next event would follow (stay tuned). I know there are a few points to improve, but it was another strong sign that events like this are needed to bring together the fintech and tech worlds.

At this point, I want to say thanks to Banxware and Weavr for sponsoring, to Candis and Hi Health for their presentations, and to Meera (Element VC), Niclas (Tidely), and Aria (Accenture) for joining me during the panel discussion.

In this edition of Embedded Finance Review, I cover:

- 💻 GoDaddy's steady development towards an embedded finance player

- 🚫 More insights on Modulr’s current limitation in the UK

- 🎒 Block is acquiring a fintech startup and Motive is launching a fleet card

- 👷♂️ Is the intersection of employer and employee a big opportunity for embedded finance?

- 🕵️♂️ There are two jobs in embedded finance and consumer fintech on the job board.

Thank you and the other 863 subscribers for supporting my work!

Now you can get rewards for referring new subscribers to Embedded Finance Review! In the past few months, I have tried a few things to grow my subscriber base. While some of them helped to grow the total number, I am exploring different ways to target high-quality subscribers with my ideal reader profile. And what better place to start with that than the existing subscriber base? 🙏

GoDaddy shapes its payments strategy and gets ready for other embedded finance products?

Web hosting provider and domain registrar GoDaddy announced this week that they are partnering with Early Warning. Early Warning is co-owned by a number of US banks and is the company behind the p2p payment solution Zelle. The partnership enables Godaddy’s customers to accept payment via the popular p2p payment method.

But let’s take a closer look at the steps GoDaddy has taken in the previous years towards embedded finance, and let’s speculate what could follow.

GoDaddy’s first and (likely) most significant step towards embedded finance was their acquisition of Poynt in December 2020. Poynt offered a suite of products tailored to small businesses, including POS, payment processing, and invoicing. This acquisition enabled GoDaddy to extend their existing offering around domains and websites and offer ‘an unified commerce platform’, which was the foundation for everything that followed.

In the following years, GoDaddy extended this offering and launched a POS terminal for their customers with brick-and-mortar stores. Due to the acquisition of Poynt, GoDaddy has become a payment facilitator. This means, put simply, that GoDaddy can handle payments for their customers (= merchants), and the merchants do not need to work with an alternative payment facilitator (i.e., Stripe) or work directly with an acquirer (this is often not possible for SMEs anyway). Becoming a payment facilitator does not only mean GoDaddy can offer payment services to its customers, but it will also generate revenue from these services.

If you are a frequent reader of this newsletter, you might know that I believe that there are quite a few companies out there that follow Shopify’s embedded finance footsteps. And yes, I also believe GoDaddy is such a company, and in this case, they even serve the same kind of customers: e-commerce merchants. Shopify’s embedded finance journey went from payments to lending to banking. So if GoDaddy gets hooked on embedded finance with their payments product, will a banking and lending product follow as well? Personally, I believe all signs point in that direction. Especially when you study their existing products and think about how nicely they could be enriched with embedded finance.

… Did I get you interested in the possibilities of embedded payments? Then have a look at PYMT’s blog post and video in cooperation with Fiserv.

Non-Financial Brand News

🇺🇸 Block acquires music financial services startup Hifi. Hifi is a financial rights organization for artists, enabling users to track their royalty income through a dashboard that aggregates data from various sources, such as music labels. This is Block's second acquisition in the music space.

🇺🇸 Motive launches the Motive card and delivers clients up to 10 percent savings. Motive offers a vertical SaaS solution in the fleet management space that is designed to combine multiple services in one place, including driver safety, spend management, equipment monitoring, and fleet management solutions.

🇸🇪 Spotify unveils a hub to let fans buy artist merchandise. The announcement comes weeks after reports that Netflix was making show merchandise available, making promos and purchasing available from a show’s launch.

🇨🇦 Xero partners with Royal Bank of Canada to help businesses simplify supplier payments. The primary benefit of this integration is the automation of the invoice-to-pay process, centralising payment workflow management to enhance efficiency and cost savings.

🇬🇧 Trade Ledger embeds working capital options within Microsoft Azure and Teams. The solution gives commercial banks the opportunity to integrate generative AI for the benefit of their business customers.

🇳🇱 Tebi, a startup providing entrepreneurs with tools to better manage their businesses, has announced a cash register platform to introduce Tap-to-Pay in the Netherlands.

🇺🇸 YouTube unveils features to boost creators’ shopping revenue. The features simplify the marketing and sale of products within videos.

🇺🇸 Etsy is working with Payoneer to help more sellers get paid in their local currencies.

🇺🇸 Navan collaborates with Citi to launch a travel and expense system for commercial clients.

Modulr agrees with regulator to stop onboarding new partners

In the past edition of Embedded Finance Review, I shared a link to the website of the UK regulator FCA that stated that British banking-as-a-service provider Modulr will not onboard any new agent or distributor unless the FCA approves it.

This week, we are getting a bit more input on the story in Sifted’s article. It is important to highlight that the restriction is UK-only (EU business is not affected) and that Modulr can still onboard ‘normal’ customers, i.e., a fintech company that wants to launch a consumer or SME-focused fintech product. The current restrictions are only affecting Modulr’s ability to onboard new agents or distributors. In simple words, an agent or distributor is an unregulated company (similar to the fintech company above), but instead of serving directly to a consumer or SME, an agent or distributor is selling to another company, which then sells these services to a consumer or SME. Basically, adding another ‘B’ to the value chain (i.e., B2B2B2C instead of B2B2C).

If you have (a bit of) experience with fintech-as-a-service, you will know that the intersection of a regulated and unregulated entity is the area where the biggest problems arise. In German we have this term of ‘predetermined breaking point’, and while nobody wants such a breaking point, the way companies collaborate today often feels like it is intended. What do I mean by that? Most of the problems that arise are in the area of customer onboarding (KYC/KYB), ongoing monitoring, and appropriate actions when something suspicious occurs. A fintech company that is regulated and serves consumers or SMEs directly will have to build (internal) products and processes to ensure that they act within these rules. A as-a-service provider has to do the same but might transfer some of the responsibilities to their customers. That can be challenging already, since the unregulated customer might pass the audit for onboarding but might not be able to do the best job in day-to-day operations. Imagine adding another layer to this. Answering the question ‘who is responsible’ can often be answered easily, but how do you ensure that the other side is actually doing their job correctly? Yearly audits and random checks throughout the year? That might not be sufficient.

Luckily, onboarding and compliance providers are building new products to address these needs. But our industry is evolving quickly, and with embedded finance, we will see a lot more activity. This brings me to the elephant in the room. At the moment, the regulators are ‘only’ sanctioning specific infrastructure providers (i.e., Modulr, Solaris, Railsr in Europe), but the big question is whether they will continue to do that or change the way the industry works. I described some of the challenges of the fintech-as-a-service business at a very high level. But when you put your ear into the market, you can hear a lot more (scary!) stories about how the (agent) model is used in a way that it is not intended to. So will regulators continue to patch a tire or change the wheel? What do you think?

Infrastructure News

Lending

🇸🇪 Climate fintech Cloover secures €7 million in pre-seed funding to expand its renewable energy subscription services across Europe.

🇩🇪 B2B BNPL player Mondu registers with the FCA and goes live in the UK.

🇬🇧 iwoca secures £200 million debt facility for its direct lending and embedded lending product offerings.

Banking

🇩🇪 Embedded banking provider Dock Financial acquires Paydora Finance, a provider of a whitelable banking product.

🇬🇧 Andaria announces strategic partnership with Discover.

🇺🇸 Marqeta unveils a credit card platform, adding intuitive credit card program management tools and creating a one-stop shop for launching consumer and commercial credit programs.

🇺🇸 Fiserv has introduced a new set of APIs that aim to offer financial institutions embedded finance capabilities.

🇺🇸 Galileo obtains a multi-market Mastercard certification that enables it to provide services in five new LATAM countries.

Investing

🇩🇪 Investment infrastructure provider Upvest secures €30 million in funding and enters a partnership with BlackRock.

🇪🇸 Flanks secures $8 million for their open wealth platform.

🇺🇸 Brokerage platform Alpaca plots Asian expansion with SBI partnership.

Is the employer-employee intersection an ideal place for embedded finance?

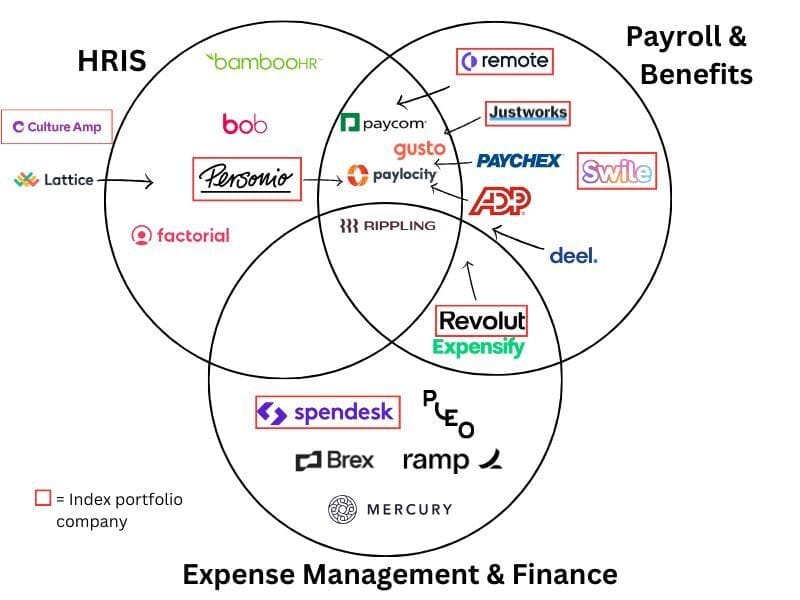

One of the beauties of working in embedded finance is that you get to learn about many different industries. Some of you know that in 2020 I was involved in the go-to-market activities for an European embedded banking provider, and I was looking for embedded finance hotspots. The intersection of employer and employee is a really interesting one with many different use-cases: corporate expense management, (tax-deductible) employee benefits, pensions, insurance, and so much more.

So if it’s your job to understand such areas better, have a look at the three following posts that caught my eye:

- The global HR superapp battle is heating up

- Why there can’t be an HR superapp

- Interview with a founder who intends to build an HR superapp

Insightful reads

🛠️ Fundraising for fintech infra is different

📱 Millennial and Gen Z consumers prefer brands over banks

✍️ One in three British adults uses BNPL

🎙️ Podcast: How embedded finance unlocks new profit centers

Job Board

1️⃣ Head of Sales (Northern Europe) at an embedded banking provider

2️⃣ Product Manager for the European expansion of an UK fintech

Does one of these roles sound interesting to you? Hit reply, and I will tell you more!

Are you hiring? Submit your vacancy and get featured in the next edition.

Are you looking for a new opportunity? Submit your profile and we will send you suitable opportunities (we won’t share your name with anybody).