Hi {{first name|embedded finance friend}}

This is going to be a fun week! On Thursday morning, I will be publishing my 30-slide embedded finance intro guide. And on Thursday evening, I will be welcoming the local embedded finance community for our fourth event in Berlin.

My slide deck: This week you will not get one but two newsletter emails from me. Initially, when I started turning some of the event slides into a proper deck, I wanted to publish it as a lead magnet for my newsletter. This means every new subscriber that subscribes via the lead magnet would get the deck into their inbox. But I know many of my existing readers will want to take a look as well. That’s why I will send the deck to every existing subscriber on Thursday morning and include it in the welcome mail for every new subscriber from then onwards.

My Event: Drinks and food are ordered, and the slides are (almost) ready. I can’t wait for Thursday when many subscribers join for our 4th embedded finance event in Berlin. I will make sure to share a short recap in next week’s newsletter. Are you interested in partnering for a next event or discussing other event concepts? Then head over to the Embedded Finance Review event page, where you will find some additional info and a link to the sponsorship page.

But now lets dive in 👇

Advertisement:

Boost your conversions and save time with Waalaxy!

- Generate hundreds of leads on LinkedIn starting at €0 per month.

- Automate all your actions and let the app handle the rest.

- Zero skills needed.

What do teams worry too much about when building a new fintech product?

In the newest podcast episode, I am speaking with William Lorenz. William is a two-time fintech founder and spent five years at a British banking-as-a-service provider.

Similar to myself, he currently works as a fractional fintech advisor with clients in the UK, EU, and the rest of the world. So we had a lot to chat about, from the key ingredients for a successful embedded finance product launch to the selection criteria for a new bank partner. We covered a lot of ground and shared different experiences, especially aimed at people building new fintech or embedded finance products.

You can find the episode on Spotify, Apple Podcasts, and YouTube.

This time we also recorded video and uploaded the interview to YouTube. What do you think about this format?

HSBC launches embedded finance joint ventures with Tradeshift

What happened: British Bank HSBC has finally announced more details about its new embedded finance joint venture with Tradeshift (Paypers). To put simply, HSBC adds its payment, trade, and financing capabilities, and Tradeshift adds its AP automation software. Companies that integrate the solution of the new joint venture, which is named Semfi, can leverage both capabilities from one source. The newly formed company will likely focus on Tradeshift’s existing customers first before expanding its reach.

What else you need to know: The launch announcement was already expected for the first half of 2024. Both companies announced the joint venture already in 2023 (Fintech Futures) when it shared initial details about the leadership and equity structure (75% HSBC and 25% Tradeshift).

My comment: I am certain that more and more banks will look for such partnerships, especially with a focus on SMEs and lending. HSBC has been pretty active in the embedded finance space but also shut down promising product launches quickly. On another note, HSBC has decided to write off its investment in Monese (Fintech Futures). Monese started as an immigrant focused banking product but also launched a core banking offering.

Investment infrastructure provider WealthKernel expands into EU

What happened: British WealthKernel provides an ‘embedded investment’ product offering and has announced that it has received a licence in Spain (WealthKernel). Different fintech and investment providers that don't want to develop the technology and regulatory requirements themselves use WealthKernel's investment-as-a-service solution to launch investment products. Embedding investment products into a non-financial user experience is not easy. That’s why WealthKernel and many other providers focus their sales efforts on fintech and investment companies. It seems that WealthKernel will use its newly obtained licence in Spain to target the local market but also intends to passport their licence into other European markets.

My comment: There are similar providers to WealthKernel both in the UK (i.e., Seccl) and in the EU (e.g., Upvest and Lemon Markets in Germany). However, it seems that WealthKernel is the first provider that has a licence in two different markets. The choice for Spain is a bit of a surprise to me, as I would have assumed that the adoption of investment products in Central or Northern Europe would make it easier to find partners. But perhaps the regulatory situation was a big factor in this decision. (If you know more, ping me!)

Update: A few hours after publishing this edition, Upvest announced that it has secured their licence in the UK (LinkedIn). Thus, WealthKernel was the only investment-as-a-service provider with dual setups in the UK and EU for just a few days.

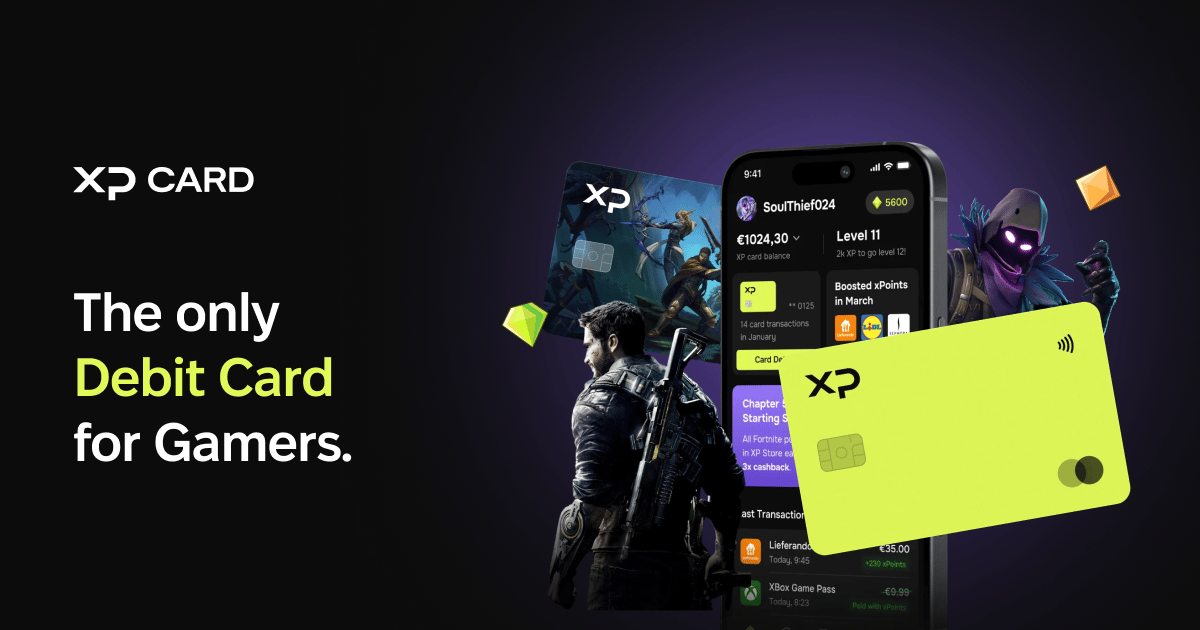

Gaming-focused fintech startup XP Card partners with rather traditional bank

What happened: The German fintech XP Card has announced that it partnered with Advanzia for its newly launched gaming credit card (FinanceFWD, German only). In case you have not heard about Advanzia before, the German bank is a popular partner for co-branded consumer credit cards. Thanks to the partnership with various brands, Advanzia offers co-branded credit cards in the travel, hotel and beer industries. And yes, you read that correctly; you can get a credit card from a beer brewery.

My comment: XP Card and also the other brands using Advanzia are technically not pure embedded finance cases. They either do not embed the financial product seamlessly (co-branded credit cards) or they are fintech companies (XP Card) that advertise financial products as their core feature. That being said, XP Card is a great example of targeting a niche customer segment and combining financial products with something non-financial (gaming in this case).

Consumer interchange is very low in Germany and the rest of EU and the target group is likely not willing to spend much on annual card fees. Therefore, XP Card will likely look for other revenue streams shortly (or maybe is already working on it) and the most logical one is to partner with companies that want to sell to the gaming community. But XP Card and their customer base will need to have a relevant size to achieve that.

Short stories

- The British banking infrastructure provider Manigo enters administration. The company offers an orchestration product, leveraging various banking partners in the background. The article on Fintech Futures states that the fallout of a major project caused the negative developments.

- Over the past few months, consultancy Synpulse has conducted an embedded finance and banking-as-a-service study on the Swiss market. It presented the findings last week in Zurich and you can access the written German report.

Lars’ corner: How can you make money with embedded finance?

The concept of embedded finance is great. But specific products will only succeed if they add value. For the user but also for the brand.

A couple of weeks ago, the team from The Paypers invited me to write an article about something in embedded finance. And how you make money with embedded finance is probably one of the most important questions to discuss.

In my article, I focused on my learnings from being an embedded finance advisor for almost two years. I shared the four most common ways for brands to make money with embedded finance.

Head over to The Paypers to read the full story.

Somebody forwarded you this email? Subscribe for free.

Are you planning to start your own newsletter? Check out Beehiiv and get 20% off.