Hi {{first name|embedded finance friend}}

I landed in Delhi yesterday and will be staying here for a few days to meet (some more of) my family-in-law. I haven’t been in the city for over ten years but it looks like traffic hasn’t changed since then ;-) We are heading back to Mumbai on Thursday for the final week of our India trip. And it just happens, that the conference Global Fintech Fest will happen on our final days in Mumbai (August 28th-30th). I moderated (remotely) two embedded finance panels in the past years, and am looking forward to join this year in person. Reach out if you are around, I would love to dive a bit more into the local embedded finance community.

Due to my travel and the Indian celebrations (Rakhi), writing and publishing this newsletter was a bit rushed and delayed. I hope I was able to keep up the level of insights you expect. Please use the survey at the end for your feedback 🙏

Let’s dive in 👇

“You can’t fight city hall”. This is one of my favorite phrases when talking about fintech regulation. Or if we want to take a stoic mindset, we can also say we shouldn’t worry about things that we cannot control. What has happened?

In the last weeks, we had two separate fintech companies that are restricted in onboarding new clients in Italy. Initially, SME neobank Qonto received in late July the order from the Bank of Italy not to onboard any new customers until it improves its AML operation (Fintech Futures). A few days later, we learned that Lemonway has received a similar order (The Paypers). While Qonto is a pure fintech player, Lemonway provides IBAN infrastructures to other fintech companies and non-financial brands. Additionally, I am hearing rumours from at least one more embedded finance infrastructure provider that is facing similar issues in Italy.

So the main question after reading all of this is whether all these companies have not taken the appropriate effort to comply with local regulations or if the Italian regulator has changed. From what I can see, it is probably a mix of the two and it is not unlikely that the Italian regulator will take a closer look at other players too.

What can other companies learn from this? As mentioned in the beginning, you cannot or should not fight the regulator (quite obvious isn’t it). But sometimes you can choose your battle, especially if you are launching a product in the EU. Depending on your financial product, you can sometimes choose the country which regulation will apply to your product all over the EU. This means, you can choose a country whose regulator is more open to fintech solutions versus regulators that require intense and lengthy processes. In reality, this means that either you or your regulated infrastructure provider has a licence in one EU country but can use this licence also in other EU countries. This concept is known as passporting. For example, the German B2B BNPL provider Mondu has recently obtained an e-money licence in the Netherlands (Fintech Futures). Likely, Mondu wanted to avoid the German regulator which is “not very popular” among fintech companies to work with. In Mondu’s case (and similarly also German Pliant that chose to obtain its licence in Finland), they can passport their licence to many EU countries and offer the same product.

So should Qonto, Lemonway and other embedded finance companies also opt for this approach? Well, as I mentioned it depends on the product you are offering. Both companies actually have a French licence which they passport to Italy. However, both companies are offering local Italian IBANs (IBANs starting with country code “IT”) which is an important feature for their own clients. In order to offer local IBANs, the regulated company needs to open a local branch in Italy, thus, they need to comply with the Italian regulator,

This makes it a great example, that sometimes you can choose the battle (i.e., Mondu or Pliant) but sometimes you cannot. And obviously, if you are in such a situation it is important to comply with the local requirements. Not because it is the right thing to do, but because sooner or later it will backfire and impact your business. It’s a bit like tech debt.

If you are interested in licencing and passporting topics within the EU, let me know and I will invite the right person for a podcast episode. Otherwise, I can also recommend Alex Johnson’s piece “The refs always wins” with an US view on the same issue.

Property management and used gadget platforms launch embedded lending products

Embedded lending is on fire. I will touch on this next week as well, when I publish a new podcast episode (and I am looking for more guests for other aspects of embedded lending).

Specifically in the past few weeks, I have noticed an increase in European non-financial brands announcing lending products. Or rather announcements from their respective infrastructure providers to be precise. Most recently, the two Berlin-based embedded lending providers Banxware and Finmid have announce new partners. Firstly, vacation rental provider your.rentals has announced a partnership with Finmid which provides a lending and cash-advance solution for companies using the your.rentals portal to manage their rental units (Finmid). Secondly, Refurbed, a provider that buys and sells used gadgets, announced a partnership with Banxware which offers a financing solution for its business customers (LinkedIn). Both examples are “prime” embedded lending solutions as neither your.rentals nor Refurbed are fintech companies or financial institutions.

If you have read previous newsletters, you will also remember that eBay, Enpal, Urban Sports Club and many more launched financing products in the past weeks. Most of these companies tend to have a marketplace or digital platform model and I expect many more to follow. Hokodo, a UK based BNPL provider has published an European B2B marketplace map (Hokodo). Perhaps it would be a good exercise to mark all marketplaces that offer financing products today and compare it with in a year from now?

Nevertheless, we should remember that these are all only product launches. Similar to startups, not every product survives mid or long-term. It is great to see that many non-financial brands understand the embedded finance opportunity, but they will also make sure to address an actual pain point of their customers. Throwing lending products at customers won’t be successful, but if they can create the right financing products (i.e., amount, interest rates, duration and repayment terms) and place them at the point of need (!) then they might (!) succeed. While all financial products can add value, lending products are often the ones that create flywheels. But more on that at another time :)

Are embedded payouts the new growth opportunity?

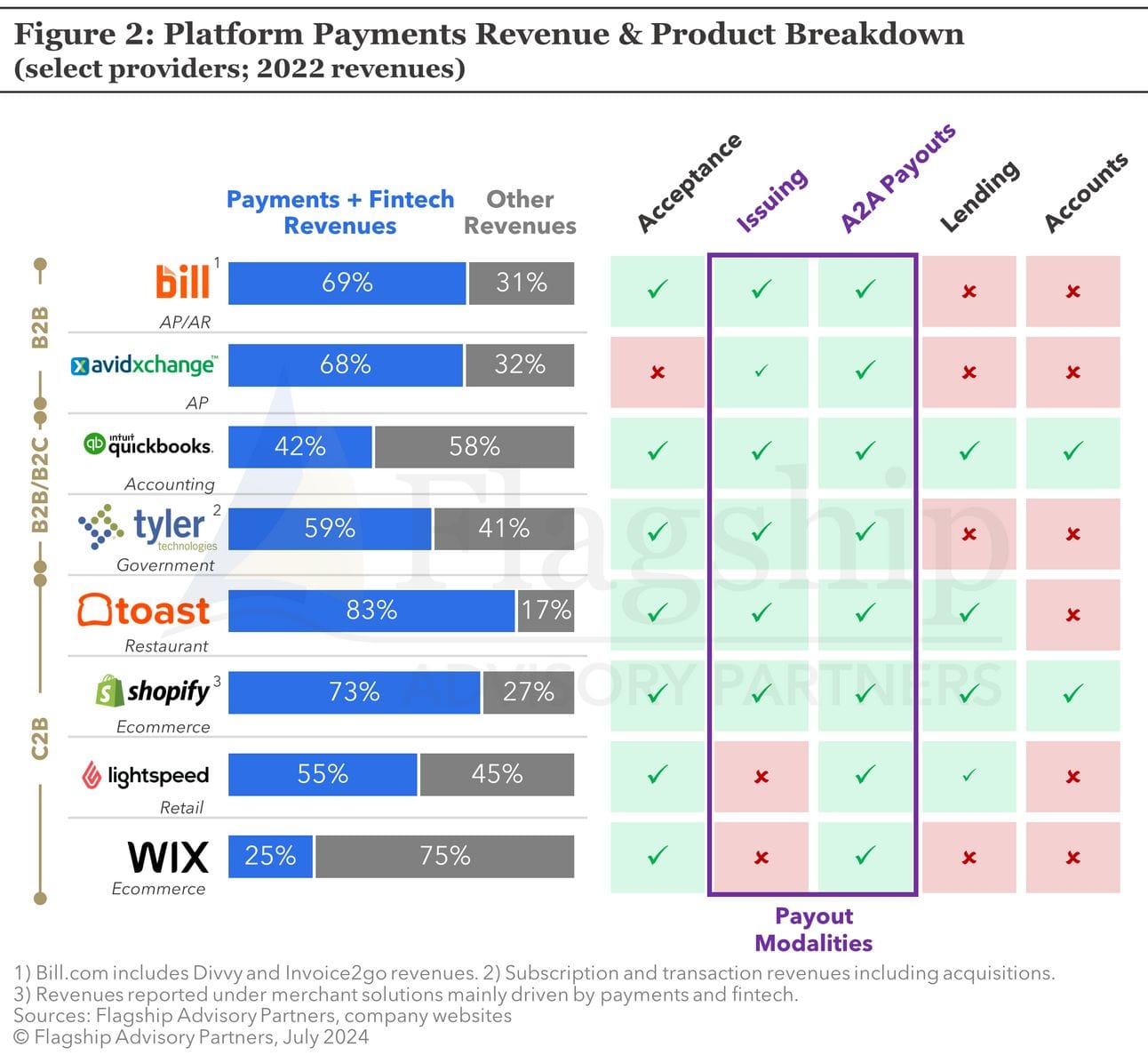

Flagship Advisory Partners published another great report, this time covering embedded payouts (Flagship Advisory Partners). The report focuses strongly on business-to-consumer payouts in the US, however, I found it even for non-US readers very interesting.

Personally, I believe the insights and graphics show very well the embedded finance journey that many companies are in. As usual, US companies were the first to discover this and a bit ahead than other companies, however, it indicates a development we are likely seeing in other geographies soon as well. Naturally, each company starts with the financial product that adds the biggest value to their core product, and as we can see in the report, many of the displayed platforms and vertical SaaS providers started with embedding payment acceptance for their business customers. But other products followed soon after, including lending and banking products. Now it seems payouts could be the next big topic for many of these providers.

When will X launch its payment feature?

The US social media X continues on its journey to become a financial hub for its users. For the plans of its owner Elon Musk, the company requires money remittance licences in all US states and, as of early August, it has received them in 33 states (PYMNTS; X). Previously, Elon Musk has stated that he aims to launch X’s financial services products in mid 2024, and according to some user’s screenshot (TechCrunch), the technical development seems to be ready for the launch. However, this is likely only going to cover the peer-to-peer payment services the company is envisioning. For the logical next step, processing payments between businesses and consumers, basically enabling in-commerce services in X, the company will need to obtain a payment processor licence in each state (Stripe). Peer-to-peer payments is a nice feature, but players like Venmo and Zelle have addressed this need already in the past few years. Thus, peer-to-peer payments itself is not a game changer anymore. And additionally, only the commerce functionality provides actual revenue potential for X. So when we see the first financial product from X being launched, we should take a closer look to understand its potential impact on the business.

Elon Musk and X is extremely polarising these days. For me personally and probably for many others, it can be hard to exclude all of their activities and focus purely on their their embedded finance journey. Nevertheless, it is one of the rare examples where you can follow (at least partially) publicly how they build their products.

Apple finally provides access to NFC

Earlier this year, Apple had finally giving in to the European Union’s request and will be providing access to the iPhone’s NFC to third party developers. Last week, it was announced that Apple is opening the infrastructure in a few selected countries (no EU country is included) and is planning to add more countries soon (Fintech Futures). Apple fought for the longest time against this. My guess is that they knew from the beginning that they will lose the fight, and winning probably wasn’t their main objective but rather to delay the decision. With Apple Pay developing into a highly accepted payment method by consumers and businesses, it will be much harder now for third party developers to succeed with their own solution. It will be interesting to see what kind of companies are exploring such opportunities. Personally, I am lot more excited about use-cases outside of the traditional payment products. It is hard to believe that banks, fintech companies or non-financial brands will be able to build a better Apple Pay product, however, the NFC infrastructure also includes corporate badgers, car keys, closed loop transactions and more. Apple is in a perfect position to build great mass market products, but other companies might be able to use the NFC access for niche and vertical solution. What impact will this have on embedded finance? Let’s see 🍿

Did you know…?

There are many reasons that embedded finance is a hot topic, even though the concept has been around for decades. Personally, I would say that new infrastructure provider, the rise of fintech companies in the 2010’s, new regulation that aims to reduce entry barriers and the success of digital platforms are the most important ones. But there is actually one more reason that embedded finance became a hot area in the years around 2020/21: Covid-19. While it is hard to find evidence that a company has launched an embedded finance product just because of Covid, there is evidence that many companies have accelerated their embedded finance products because of Covid. Remember, Shopify (banking & lending), Uber (banking), Doordash (lending) and many other digital players launch embedded finance products in those peak Covid years.

Somebody forwarded you this email? Subscribe for free.

Are you planning to start your own newsletter? Check out Beehiiv and get 20% off.