Hi {{first name|embedded finance friend}}

in a bit over a week, I will be welcoming the local embedded finance community to our fourth Embedded Finance Review Event in Berlin. This all started with a small idea for a one-time event early last year, but has evolved into regular events throughout the year in different cities. If all goes well, the number of events per year will increase in 2025. But more on that another time. Right now, I am doing the final bits of preparation for the event on October 10th. And we have a few tickets left. So if you are in Berlin, make sure to register and join us!

Additionally, I will be publishing an extended embedded finance slide deck next week. Since becoming an independent advisor in early 2023, I have had the opportunity to speak about embedded finance at various occasions. I have started with a simple slide deck, which has evolved into ~ 30 slides by now. The deck consists of an introduction to embedded finance combined with common challenges and solutions for non-financial brands. I will be sharing the deck exclusively with my subscribers on October 10th, so make sure to watch your inbox. And if you are willing to provide final feedback in exchange for a sneak peak, feel free to ping me :-)

And now let’s dive in 👇

Advertisement:

🦾Master AI & ChatGPT for FREE in just 3 hours 🤯

1 Million+ people have attended, and are RAVING about this AI Workshop.

Don’t believe us? Attend it for free and see it for yourself.

Save your spot here. (100 free spots only)

Highly Recommended: 🚀

Join this 3-hour Power-Packed Masterclass worth $399 for absolutely free and learn 20+ AI tools to become 10x better & faster at what you do

👉Save your seat now (FREE for First 100)

🗓️ Tomorrow | ⏱️ 10 AM EST

In this Masterclass, you’ll learn how to:

🚀 Do quick excel analysis & make AI-powered PPTs

🚀 Build your own personal AI assistant to save 10+ hours

🚀 Become an expert at prompting & learn 20+ AI tools

🚀 Research faster & make your life a lot simpler & more…

👉 Register here (Offer valid for First 100 people only)🎁

A Swedish retailer launches a banking product in partnership with SEB Embedded; can it succeed?

The Swedish retail brand Hemköp has announced the launch of a new consumer banking product. They also shared that they will partner with the banking-as-a-service unit SEB Embedded from the Swedish bank SEB (Axfood). It was expected that SEB Embedded will announce a new client very soon and if you take a closer look, Hemköp doesn’t come as a surprise at all.

Firstly, SEB Embedded announced already in April 2022 that it partnered with Axel Johnson (SEB), the conglomerate that owns Hemköp through its food subsidiary Axfood. More specifically, SEB Embedded partnered with Axel Johnson’s then newly launched startup Humla. Humla is a B2B service for retailers and aims to enhance “customer offerings and increase loyalty through embedded finance.” Humla is described as the first client of SEB Embedded. This may technically be true in terms of a paying customer. But as far as I can see, there was no product launch at that point of time. Humla and SEB basically did the ground work for Hemköp’s banking launch a bit over two years later.

Secondly, Hemköp positions itself as a retailer that values sustainability. And if consumers believe that, this will be helpful to promote adjacent products like a banking offering. Consumers typically choose a bank based on their functional requirements but will also take the brand into consideration. Even though this applies to any provider, it is especially important for decisions where others can see our choice, such as the (virtual) card at the cashier or sharing the IBAN with friends.

Hemköp’s partnership with SEB Embedded might be one of the few embedded banking partnerships where I am more excited about the underlying infrastructure provider than the frontend brand. With UniCredit’s acquisition of Vodeno and NatWest’s partnership with Vodeno, SEB is a third incumbent bank with a substantial banking-as-a-service offering in Europe. Personally, I believe banks have a massive opportunity if they can figure out tech and compliance. Fingers crossed for team SEB Embedded; they seem on a good path!

But coming to Hemköp. As a frequent reader, you'll also recall Coop's story. The Swiss retailer launched a banking product in 2023 and shut it down just nine months later. We have discussed the potential reason for this failure in our podcast. From my perspective, there are two key success factors I want to touch on in regards to Hemköp’s launch. Firstly, the embedded finance team needs to ensure leadership support. If you read up about the Coop story, you would likely agree with me that the support for their banking strategy has shifted significantly. The ongoing investment in Humla since 2022 and the launch of a new product indicate that this is hopefully different for Axel Johnson. Secondly, and this is likely the biggest challenge for Hemköp’s banking product, the product offering needs to be attractive for customers. It seems Hemköp’s most attractive differentiator to other banking products is that customers can earn 25% more in loyalty points. While this may be attractive for some, it is to be seen if its sufficient to win market share. Especially when their direct competitors, such as ICA and Coop Sverige, have similar product offerings. Hemköp might be planning to launch other features or embed its banking product conveniently into the existing customer journey. But we will need to see if this is enough to win.

Hilton launches debit cards but partners with a consumer fintech startup

Hilton has launched two different debit card products in the UK (Hilton). Card owners can collect loyalty points with all eligible purchases, and when they reach a certain level, they can redeem them for free stays or other benefits. The cards are available in two tiers and cost either £60 or £150 per year.

There are two things that stand out in this offering. Firstly, the cards are detached debit cards. This means a customer only signs up for a card but not for a separate bank account or wallet. During the registration process, the card owner needs to connect her existing bank account (i.e., HSBC, Monzo). Whenever the card owner makes a purchase with the Hilton card, the funds are taken from that bank account via direct debit. A few brands in Europe are using this card product, and it is advantageous when the brand believes it cannot fully persuade its customers to leave their current bank.

Secondly, the Hilton card product is built in cooperation with Currensea and not with a banking-as-a-service provider, which is a surprise to me. Currensea is a British consumer fintech startup that offers a product similar to the Hilton Card directly to consumers. We don’t know why Hilton opted for Currensea instead of a banking infrastructure provider. Currensea is not an unknown player in the market but clearly does not have that big of a brand that this was interest for Hilton, which would be different if Hilton was partnering with Wise or Revolut for example. Perhaps the product that Currensea has built around the detached debit card is exactly what Hilton was looking for and they wanted to avoid building most of this themselves, which would have been necessary when partnering with a banking-as-a-service provider.

That being said, I am still surprised that Hilton chose Currensea. Definitely big kudos to the Currensea team, but if any subscriber has more insights or thoughts on this decision, please let me know :-)

Proptech provider Aareon launches banking product in Spain

There is a good chance you have never heard of Aareon. But if you did, you probably have some touching points with property management. Aareon is a software-as-a-service provider for property management and its history goes back to the 1950s. German Aareal Bank owns the majority of Aareon, and together with Swan, it has just introduced a banking product in Spain (The Paypers).

But Aareon is not a new player in the world of embedded finance. The core product of Aareon is a property management system, which is basically an industry niche ERP for the property industry. In this product offering, Aareon already offers payment products which it advertises under the Aareon Pay brand. To be more specific, it offers a virtual IBAN solution to rental unit owners, which can then share unique IBANs with their tenants. This completely removes reconciliation efforts, as tenants do not have to add a purpose text for the monthly rent transfer anymore.

Now Aareon, or its Spanish subsidiary IETS to be precise, went a step further and launched a complete banking product in Spain under the brand TucoBan. The product is specifically designed for homeowner associations. These associations are common in Spain and other European countries and these associations are responsible for the public space around their own properties. Onboarding and managing such associations from a financial service point of view is not always easy and the product seems to address this need.

The Verticalization of Everything

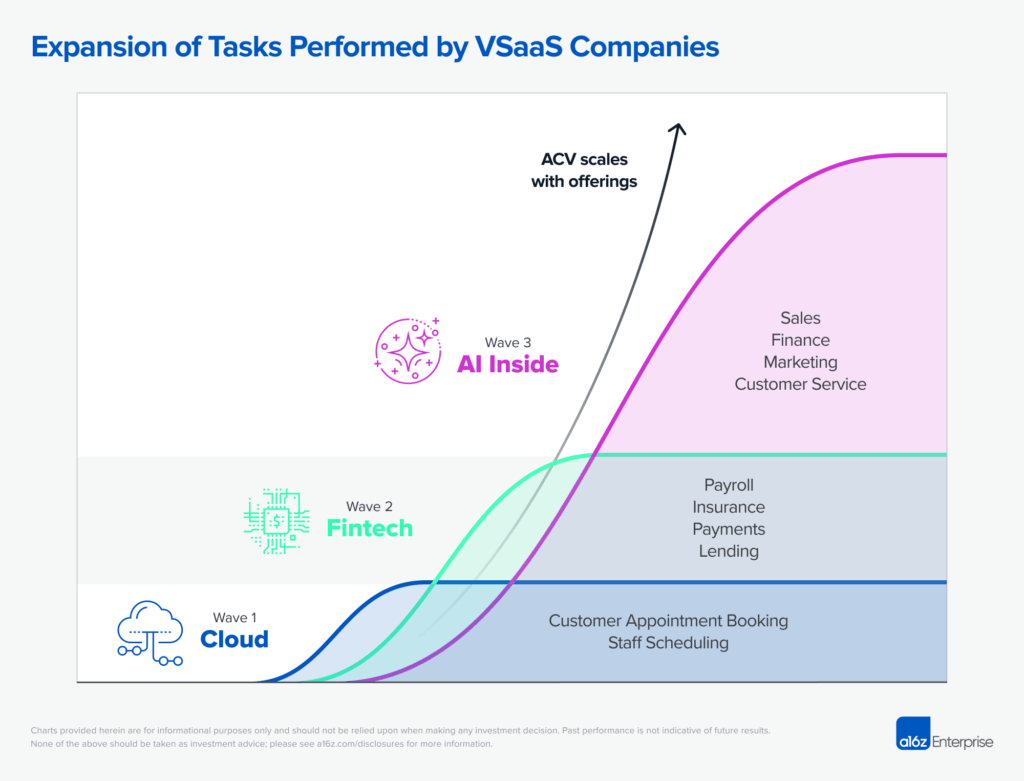

Almost every non-financial brand that I started to engage with over the past ~2 months is a vertical SaaS company. While the concept of vertical SaaS is in Europe still at the beginning, in markets like the US it is the norm.

Initially, when software-as-a-service providers became popular, almost all of them were horizontal. This means they develop a SaaS offering around a service (let’s say bookkeeping) and offer it to a wide range of customers (for example, from software developers to window cleaners). The founders of a vertical SaaS company, on the other hand, start with the customer segment (let’s say veterinarians) and build products and features for them (not just bookkeeping but also appointment booking, invoicing and so on).

Vertical SaaS companies tend to approach embedded finance much faster than horizontal SaaS. This makes a lot of sense if you understand that vertical SaaS means a lot of different services but for one target group.

In the past few weeks, I read A16Z’s “Vertical SaaS: Now with AI inside” (see image), “The Verticalization of Everything” by Pete Flint from NfX, and Matt Brown’s newly published Vertical Software provider overview.

My personal take away is that customer’s trust and access to them will become the new gold. In the old days, we went to a bank because only they could offer banking services, and the same applied to insurances, schools and everything else. With embedded finance, we are seeing how entry barriers are being removed and any company can offer financial services. And the same happens with the insurance, education or media industry in one way or another. You can probably not combine anything with everything. But industry barriers don’t matter so much more, many services are available via APIs. Perhaps this means as a founder you can build anything, the question is for whom and why you.

Insightful reads

- Finnish Alisa Bank announces merger with SME invoicing provider Puro Finance and unveils a new banking-as-a-service focused strategy (LinkedIn - english; Arvapaperi - Finnish). → Thanks to Shaul David for highlighting this to me!

- US infrastructure provider Galileo shares their view on how to build an embedded finance program from the ground up (Tearsheet).

- Standard Chartered’s embedded finance subsidiary Audax partners with consultancy Synpulse to drive embedded finance adoption among banks (Audax).

- Stripe announces B2B BNPL products in the UK in partnership with Kriya (The Paypers). Stripe made a similar announcement for the US already, where it partners with Capchase.

- The hotel-focused vertical SaaS provider Mews raised $100 million in equity funding (PYMNTS). The company offers payment and lending products and explores other financial products, as Mews’ CEO Matt Welle mentioned on our podcast episode 4.

- French bicycle marketplace Troc Vélo partners with Mangopay for consumer-to-consumer purchases for second hard bicycles (Finextra).

Somebody forwarded you this email? Subscribe for free.

Are you planning to start your own newsletter? Check out Beehiiv and get 20% off.