Hi friends

welcome to the one and only newsletter to catch up with all things Embedded Finance. I hope everybody who went to Money2020 Europe had a good time.

In this edition, I will cover:

- ☕️ Canadian Coffee Maker Tim Horton launches financial service unit

- 💳 UK Embedded Banking provider Weavr partners with Visa

- 💰 Two more acquisitions of BaaS providers in the US

- 🧑🏫 How can we close the education gap?

I am closing this newsletter with a vote, where you can decide how the newsletter will evolve.

Thanks to the 38 new subscribers since the last post. Do you know a friend or coworker who is interested in Embedded Finance? Please share EF Review with them.

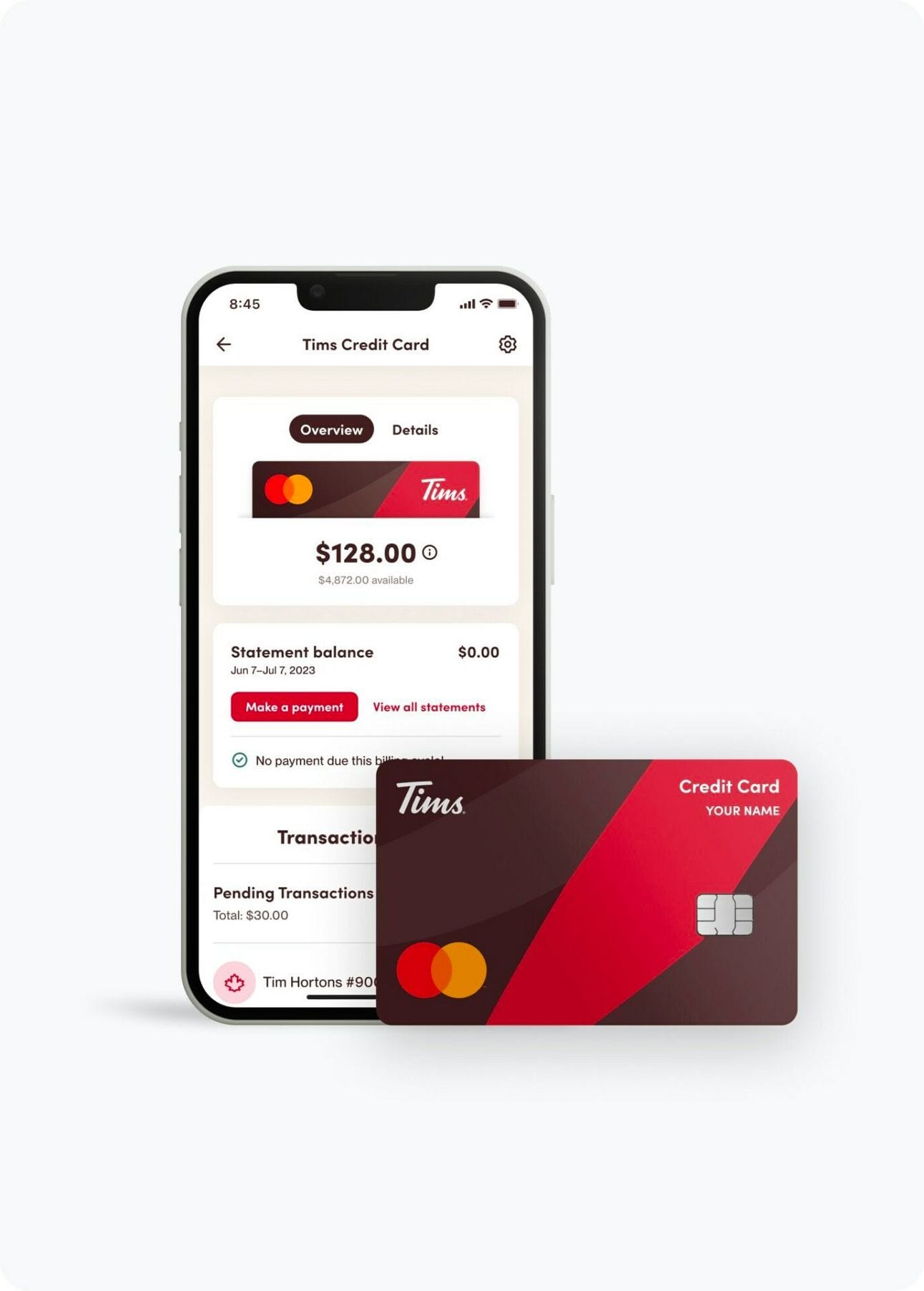

Tim Hortons Launches Credit Card

The Canadian coffeehouse and restaurant Tim Hortons launches a financial unit called Tims Financial and introduces their first product: a credit card. Customers receive reward points for different transactions and higher rewards for transactions at Tim Hortons. The company was providing a rewards app before, and launching their first financial product inside the app is the logical next step.

When you think about a coffee maker getting into financial services, you have to think about another player: Starbucks. The US coffeemaker is widely known in the fintech ecosystem as it managed to convince its customers to do something very unique: transfer billions of dollars into their wallets. But the very special characteristic of these wallets is that customers are not eligible for payouts and can only redeem the funds for Starbucks products. Starbucks launched their initial app in 2009, and customers transferred $1.3 billion into their wallets alone in Q3 of 2023.

The success of Starbucks wallet is fascinating, and other coffeemakers, restaurants, and retailers would do a lot of things to achieve similar results. But it’s not easy, and keep in mind that Starbucks started their efforts in 2009. Companies that have a strong brand and regular customers might be more likely to succeed. So perhaps Tim Hortons has a good shot at succeeding?

Other Non-Financial Brand News

🇩🇪 The digital subsidiary of real estate agent Engel & Voelkers makes a strategic acquisition of digital wealth provider wevest to expand their product offering. Previously, the digital unit offered investment products in properties, and with the acquisition this will likely extend to ETFs and other financial products. In the past, Engel & Voelkers was also working on a bank account offering but stopped those efforts.

🇺🇸 Mercedes-Benz debuts an in-car payment feature for parking. US customers will be able to identify, reserve, and pay for their off-street parking spot. Mercedes-Benz has been more frequently mentioned in payment / Embedded Finance news and it will be interesting to see how other carmakers / industry stakeholders react.

Weavr partners with Visa to accelerate Embedded Finance adoption in B2B SaaS

The UK-based embedded banking provider Weavr partners with Visa. Weavr is operating in the UK and the EU and targets non-fintech companies. These companies can offer debit card and bank account services to their own customers.

The announcement of the partnership states that the focus will be on B2B SaaS companies, one of the areas where embedded finance is expected to have a vast impact over the coming years. From a provider's perspective, it might make a lot of sense to focus on such areas.

The card schemes (Visa and MasterCard) are obviously always very interested in partnering with and, in some cases, investing (e.g. Visa invested in Solaris and MasterCard in Treezor) in the infrastructure provider companies.

Personally, I have been working with a few B2B SaaS companies and I am very curious to see what the Weavr and Visa partnership means for them. Unfortunately, the announcement has not revealed any details about the exact product offering.

Disclaimer: I have been working at Weavr until November 2022, but I have been independent since then.

Other Infrastructure News

🇫🇮 Enfuce partners with SEB Embedded. I have covered both companies, Enfuce and SEB Embedded, at various points in this newsletter. Enfuce has made some strong announcements in the past few months and gained several customers for its card-as-a-service product, including several smaller banks. The cooperation with the infrastructure unit of SEB seems like the cherry on top, as it could mean that Enfuce will be integrated into various of SEB Embedded’s clients.

🇳🇱 Banxware partners with Rabobank for expansion into the Netherlands. The German lending-as-a-service provider Banxware expands to its first new market, and the Netherlands are not an unexpected choice since Dutch regulation makes it easier for lending companies. However, it is interesting that Banxware was able to secure a partnership with one of the major banks.

🇺🇸 FIS takes over Bond and Qenta acquires Apto Payments. In the previous edition of EF Review, we covered already another US BaaS acquisition, and I indicated already that this may not be the last. Personally, I am not so surprised about Qenta acquiring Apto Payments since Qenta has been fueling its growth and is offering a BaaS product in Europe, and Apto Payment was not in the strongest position in the US BaaS market. However, the FIS takeover of Bond is a different story. Bond’s latest funding was in 2020, and in startup years, that is quite some time ago. But they did raise $32 million from names such as Coatue and Goldman Sachs (link). Perhaps they missed the right funding window and needed to find a new home.

🇺🇸 Stripe launches a charge card program to make it easy for fintech startups and platforms to offer cards with flexible credit options. Stripe has had some strong BaaS announcements in the past few years, but this new product launch comes after a bit of quietness. It’s good to see that Stripe is still committed, however, it appears that their BaaS focus remains in the US and the anticipated further rollout in Europe is paused?

How do we close the education gap in Embedded Finance?

There are currently a number of non-financial brands that have launched or are in the process of launching an embedded finance product. But the question I am wondering about is: Should this number be bigger? Do we need to speed up development? Let me share my thoughts below, and please reply to this email / get in touch if you have any thoughts.

Personally, I have been working for many years on the fintech infrastructure side and have been evangelizing open banking and embedded finance to many companies. When you are working for an infrastructure company, your motivation for increasing speed is obvious. But let’s say we all agree that more companies should launch financial products. What needs to be improved?

From my perspective, there are three elements involved for non-financial brands:

- Building

- Embedding

- Promoting

Building a financial product has never been easier. With the rise of different embedded finance providers, any company can launch a banking, lending, insurance, or investing product with much less financial and time investment than a few years ago.

Embedding the financial product into a non-financial product offering doesn’t mean the technical efforts required to embed it, but to embed it in a way that creates value for the user. Remember, combining an embedded finance product with a non-financial product should feel like 1 + 1 = 3 for the user. This requires an in-depth understanding of your customers and how they use your product. Additionally, it requires a bit of understanding of financial products: how they work, what other companies (not only direct competitors) are offering, and what the limitations / challenges are.

Promoting the financial product refers to the activities that come after the proper product launch: promoting and selling the product to your customers and integrating the financial product into your company’s flywheel. The knowledge required is likely to be a mix of understanding your customers and financial services.

So what can be done to get more companies to succeed at this? I assume we can agree that a) it has never been easier to build a financial product due to the rise of infrastructure providers, and b) successful non-financial brands will have a great understanding of their customers and their pain points. Therefore, the remaining element that could drive embedded finance implementation is knowledge transfer about financial services to non-financial brands.

How does that usually work? Personally, I am seeing two types of approaches (plus different flavours of these two approaches). Firstly, hiring an experienced fintech team with the necessary knowledge. The advantage is that you get a lot of knowledge into your company at once. The disadvantages are that these people have to build up their knowledge around your non-financial product offering, and additionally, hiring the ‘right’ staff requires knowledge of what direction the company should go. Secondly, a company could also aim to educate its existing staff about financial services. This approach might take longer but is likely to require a lower investment.

What is the right approach? I am certain that there is no one solution for all companies, and the best approach depends on a lot of variables (type of company, industry, competitive landscape and much more).

Nevertheless, I am certain that transferring knowledge about financial services to non-financial companies might be the biggest factor in increasing the speed of embedded finance implementations. What do you think? Do you agree, or do you believe there are other more important bottlenecks?

Insightful reads

🏦 How banks are staking a claim in the embedded finance ecosystem

💸 BaaS Banks Outperform Regionals in Deposit Fight

🙍♀️ UK Consumers Embracing Embedded Finance As New Payment Solutions Reach Mainstream Adoption

Starting with this edition, I will be closing each newsletter with a little survey. This time it is actually about the format of this newsletter:

Thanks for reading, and I am looking forward to your comments.

Best wishes from Berlin,